Simple payroll tax calculator

Heres the information youll need for your calculations. Fees apply if you have us file an amended return.

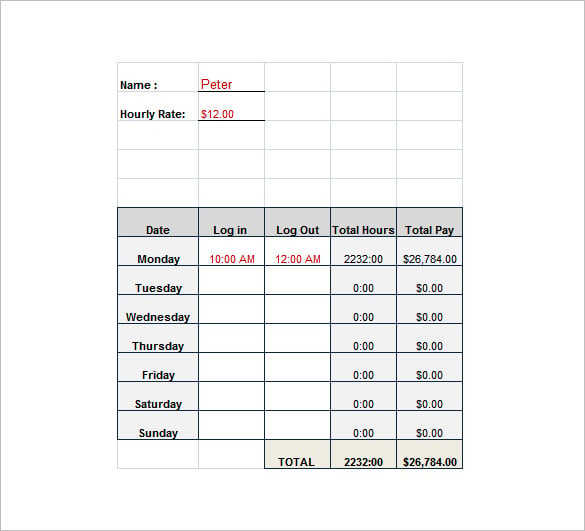

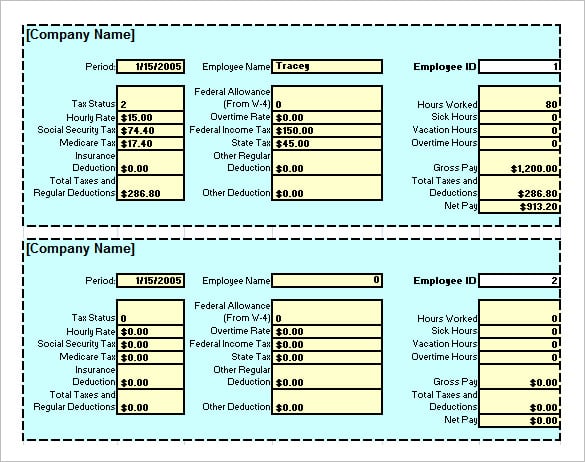

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

. Find out how easy it is to manage your payroll today. Payroll period details including the frequency of your pay periods weekly biweekly or monthly and the amount of time for that particular period. Automatic deductions and filings direct deposits W-2s and 1099s.

Flexible hourly monthly or annual pay rates bonus or other earning items. Switch to hourly calculator. Use this payroll tax calculator to see how adding new employees will affect your payroll taxes.

Employer Paid Payroll Tax Calculator. I understand that I am registering for access to HWS. Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions.

Use our free check stub maker with calculator to generate pay stubs online instantly. Starting price for simple federal return. Payroll tax deductions are a part of the way income taxes are collected in the US.

The steps our calculator uses to figure out each employees paycheck are pretty simple but. Americas 1 tax preparation provider. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs.

How to calculate payroll for tipped employees. Browse accountants in our Partner Directory. Payroll management made easy.

This calculator will also calculate employer payroll deductions to provide a total cost of employment. Or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets.

Federal Payroll Tax Rates. Next generation payroll and HR in one powerful yet simple integrated solution for medium to large businesses. If you own a restaurant a bar or any other small business where employees earn tips from customers you have the added responsibility of withholding taxes from your employees paycheck based on the tips they receive.

The IRS urges taxpayers to use these tools to make sure they have the right. Simple steps to run payroll add benefits and more. For businesses of any size.

Included with your free trial and paid subscription to QuickBooks Online Payroll. 202223 Tax Refund Calculator. Computes federal and state tax withholding for paychecks.

The calculator above can help you with steps three and four but its also a good idea to either double-check the calculator by using the payroll tax rates below or save time and effort by using a reliable payroll service. Lowest price automated accurate tax calculations. Median time spent by QuickBooks Online Payroll users reviewing and approving payroll as of September 2021.

Our updated and free online salary tax calculator incorporates the changes announced in the Budget Speech. Small Business Low-Priced Payroll Service. Phone support is available in English and in French Monday through Friday 10 AM to 6 PM EST.

Why Gusto Payroll and more Payroll. You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year. Youll need to gather information from payroll to calculate employee withholding tax.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. All tax situations are different and not everyone gets a refund. Deduct the amount of tax paid from the tax calculation to.

Our payroll tax calculator is designed to help you quickly calculate payroll deductions and withholdings for your employees. Pre-Tax Deductions Pre-tax Deduction Rate Annual Max Prior YTD CP. Determine your taxable income by deducting pre-tax contributions.

Access our FREE payroll tax calculators. Fast easy accurate payroll and tax so you save time and money. With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start.

Payroll Deductions Online Calculator PDOC. Deduct and match any FICA taxes. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Applies to individual tax returns only. Calculate the FUTA Unemployment Tax which is 6 of the first 7000 of each employees taxable income.

The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. They can estimate their income and expenses by using one of the following two. Its a simple four-step process.

I grant HWS permission to contact me via email regarding household payroll and tax services they offer. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. IR-2018-36 February 28 2018.

1 online tax filing solution for self-employed. Fast and basic estimates of Fed State Social Security Medicare taxes etc. Note that if you pay state unemployment taxes in full and on time you are eligible for a tax credit of up to 54 which brings your effective FUTA tax rate to 06.

Pre-tax Deductions 401k IRA etc Check Date MMDDYYYY Next. All fields are required. Total Non-Tax Deductions.

US Tax Calculator and alter the settings to match your tax return in 2022. Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance. Elective Deferrals401k etc Payroll Taxes Taxes.

WASHINGTON The Internal Revenue Service today released an updated Withholding Calculator on IRSgov and a new version of Form W-4 to help taxpayers check their 2018 tax withholding following passage of the Tax Cuts and Jobs Act in December. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Try paystub maker and get first pay stub for free easily in 1-2-3 steps.

When you work at a job a part of your income is taken each pay period based on a number of factors including your total pay how often you get checks and how many allowances you take when you fill out your W-4 at the beginning of your time at the jobPayroll taxes can be. Try 14 days. To keep things simple for you as the business.

Employees who are paid in whole or in part by commission and who claim expenses may choose to fill out this form in addition to Form TD1. Access special offers downloads. This 80k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Wisconsin State Tax tables for 2022The 80k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Wisconsin is used for.

Must not have run payroll nor have an accountant attached. Calculating you income tax and payroll deductions including National Insurance Scheme NIS National Housing Trust NHT Education Tax ET and Human Employment and Resource Training HEART is simple with the Jamaica Tax Calculator. View what your tax saving or liability will be in the 20222023 tax year.

If you want a simple easy-to-use payroll service give us a call at 8779547873 or request a free payroll quote online.

Paycheck Calculator Take Home Pay Calculator

Payroll Tax Calculator Best Sale 59 Off Www Wtashows Com

Paycheck Tax Calculator Best Sale 57 Off Www Wtashows Com

How To Calculate Payroll Taxes Methods Examples More

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Payroll Tax Calculator Discount 50 Off Www Wtashows Com

Payroll Tax Calculator For Employers Gusto

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Payroll Tax Calculator Shop 55 Off Www Wtashows Com

How To Calculate Federal Income Tax

Tax Payroll Calculator Outlet 54 Off Www Wtashows Com

Paycheck Tax Calculator Online 59 Off Www Wtashows Com

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Online For Per Pay Period Create W 4

Tax Payroll Calculator On Sale 53 Off Www Wtashows Com

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates